Texas Bitcoin Reserve Debate: An Opinion on New Legislation and Its Implications

In recent weeks, Texas has emerged as a focal point in the ever-evolving discussion on state-level cryptocurrency policies. The latest developments, marked by the passage of House Bill 4488 (HB4488) and the pending decision on Senate Bill 21 (SB21), have put Texas at the forefront of a national conversation about how states can protect their funds while exploring investment opportunities in Bitcoin and other large-cap crypto assets. In this opinion editorial, we take a closer look at this legislation, its motivations, and what it might mean for both the crypto market and state financial management.

At first glance, HB4488 may seem like just another legislative measure. However, a closer examination of its provisions reveals a thoughtful attempt by lawmakers to separate designated funds—such as a potential Bitcoin reserve—from the state’s general revenue pool. What is at stake here is not only the safeguarding of taxpayer money, but also the pioneering of an innovative approach to integrate digital assets into state fiscal strategies.

Protecting State Funds: Understanding HB4488 in Plain Terms

House Bill 4488 has been designed to carve out a legal space for specific state funds. Among these are not only the potential Bitcoin reserve but also other earmarked funds like the Texas Advanced Nuclear Development Fund and the Gulf Coast Protection Account. Essentially, this legislation is a way to ensure that money allocated for particular purposes does not get absorbed into the broader state budget. Instead, these funds remain separate, thereby preserving their intended use and offering a degree of protection from budgetary reallocations.

To put it simply, HB4488 acts like a safeguard. Consider these key benefits of splitting and legally protecting state funds:

- Prevents the use of earmarked money for unexpected spending or shortfalls.

- Allows the state to maintain a dedicated reserve that can be tapped for specific strategic purposes.

- Introduces a level of transparency by clearly designating which funds are off-limits for general use.

This measured approach has caught the eye of policymakers not only in Texas but across the United States. When dealt with properly, such a system can help states steer through the tricky parts of fiscal management—especially when new kinds of assets, like Bitcoin, come into the picture.

Deciphering the Pending Decision on SB21: Texas’ Bitcoin Investment Roadmap

While HB4488 sets the stage by legally protecting designated funds, the actual move toward state-backed cryptocurrency investments hinges on the passage of Senate Bill 21. SB21 is particularly significant because it may formally authorize Texas to invest in Bitcoin and other large-cap cryptocurrencies. Governor Greg Abbott, who has a reputation for measured conservatism in financial matters, received this bill on June 1 and now has an important decision to make.

Under Texas legislative procedures, the governor is given 20 days following the adjournment of the session to either sign or veto the bill. If Governor Abbott does nothing, SB21 will automatically become law by June 22. This automatic enactment process ensures that the initiative for a state-backed cryptocurrency reserve is not stalled by political hesitation or procedural delays.

Opinion leaders and financial experts alike have expressed varied viewpoints on this pending decision. While some view it as a forward-thinking step that could yield substantial economic rewards, others point to the intimidating risks associated with investing state funds in a volatile asset class. This debate highlights the classic tension between innovation and fiscal prudence, a dynamic that is as old as public finance itself.

Implications for the Texas Strategic Bitcoin Reserve

If SB21 is enacted, any Bitcoin reserve established by Texas would come under the umbrella of protection provided by HB4488. This means that once a reserve is created, it would legally be separated from the general pool of state funds. This separation is critical given the tangled issues that surround state budgets, particularly when it comes to allocating resources in times of economic uncertainty.

Supporters argue that a dedicated Bitcoin reserve could serve as a hedge against economic downturns. For instance, Bitcoin has often been touted as a “digital gold” that may, at times, perform independently of traditional market forces. In periods of financial stress, such a reserve might offer Texas an unconventional cushion. Nonetheless, critics caution that crypto markets can be nerve-racking due to their well-known price swings and unpredictable performance.

To better understand the potential benefits and risks of establishing a state-backed Bitcoin reserve, it is helpful to break down the expected impacts:

- Enhanced Financial Resilience: A segregated reserve could provide a layer of financial insurance, only accessible for predetermined strategic uses.

- Market Innovation: Texas may set a precedent that could inspire other states to explore similar measures, thus potentially bolstering the legitimacy of digital assets.

- Risk Exposure: Allocating public funds to Bitcoin introduces a level of volatility that might not align with traditional public finance practices—an issue that lawmakers need to tackle head on.

The conversation around these factors is ongoing and remains central to Texas’s policy debate on state-level cryptocurrency investments.

Legally Protected Cryptocurrencies: A Growing Trend Among States

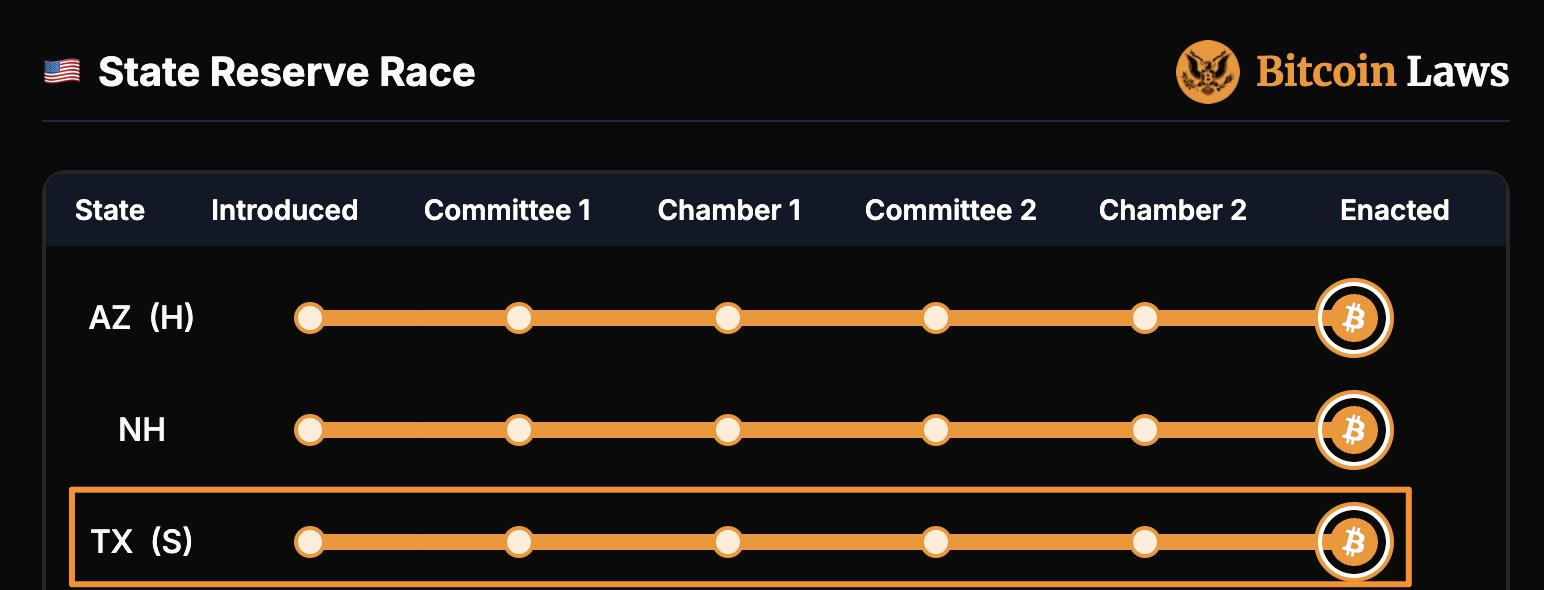

Texas is not the only state exploring new ways to incorporate digital assets into its financial strategy. Arizona, for example, has already enacted legislation to establish a similar cryptocurrency reserve fund. This trend reflects growing interest among state legislators in harnessing the potential of digital currencies while mitigating the confusing bits that come with traditional approaches to public fund management.

Here are some common themes driving state-level legislative efforts across the country:

| Key Objective | Description |

|---|---|

| Financial Security | Designating funds for specific purposes to avoid budgetary reallocation during emergencies. |

| Innovation | Exploring new asset classes like cryptocurrencies to diversify revenue streams and savings. |

| Legislative Precedent | Setting up frameworks that other states can model on their approaches to public financial management. |

| Risk Management | Balancing the potential rewards of digital assets against the volatile nature of crypto markets. |

These agendas indicate that states are not merely chasing cutting-edge trends; they are attempting to get into the thick of creating robust policies that address the little details of both finance and technology. Legally protecting cryptocurrency reserves is just one manifestation of this broader commitment to innovation in governance.

Risk and Reward: Evaluating the Investment Angle for Crypto Reserves

The decision to potentially use state funds to invest in Bitcoin is a strategic move with pros and cons. On one side, Bitcoin’s growing mainstream acceptance and its reputation as a store of value offer a compelling case. Given its historical performance and increasing correlation with global economic trends, Bitcoin might present an unconventional but promising addition to a diversified financial strategy.

However, there are also several tricky parts to consider. Critics argue that the volatile nature of cryptocurrencies can expose state funds to significant risks. A sudden drop in Bitcoin’s value, for example, could lead to an off-putting impact on the state’s overall financial health. This is particularly worrisome given that state budgets typically need to prioritize stability and long-term sustainability over aggressive growth strategies.

When assessing the trade-offs, it is worth keeping in mind several key points:

- Economic Diversification: The inclusion of a crypto asset in the state portfolio can be seen as part of a broader diversification effort. Supporters claim that a diverse portfolio may help cushion the impacts of market fluctuations.

- Risk Tolerance: Unlike private investors, state funds are accountable to taxpayers, and there is a high degree of transparency expected in how these funds are managed. The risk tolerance for state funds is generally lower than in the private sector.

- Liquidity Concerns: While Bitcoin is traded around the clock and offers high liquidity, the regulatory environment surrounding crypto transactions remains in flux. This can make it challenging to figure a path forward under legal and compliance frameworks.

In weighing these arguments, it is evident that any move toward investing in Bitcoin requires careful consideration of both the advantages and the potential downfalls. The decision, ultimately, reflects not only a financial gamble but also a philosophical stance on the embrace of emerging technologies by state governments.

Legal Challenges and the Fine Points of Crypto Legislation

The legal landscape for cryptocurrency investments is full of twists and turns. While HB4488 and SB21 provide a structured framework for such investments, they also highlight some of the challenging parts inherent in adapting old legal frameworks to new technologies. Lawmakers must deal with additional layers of ambiguity regarding the enforcement of such laws and the overall regulatory environment governing digital assets.

Key legal considerations include:

- Jurisdictional Questions: Whether funds held outside the state treasury enjoy the same protection as those held within traditional bank accounts.

- Regulatory Overlap: How federal guidelines and executive orders, such as those proposed by Representative Tim Burchett in support of a national strategy, might interact with state laws.

- Legal Precedents: The ways in which similar legislations, like those in Arizona, have held up under judicial scrutiny and what lessons can be drawn for Texas.

The presence of these legal twists and turns means that any future state-level policy on cryptocurrency investments must be constructed with both flexibility and clarity in mind. It is a challenging balancing act—to protect and promote innovation while minimizing exposure to unwanted legal entanglements.

Pondering Fiscal Responsibility in a Digital Age

State governance has long been about striking a balance between frugality and investment in future growth. The possibility of a state-approved Bitcoin reserve adds a new dimension to this equation. On one hand, there is immense potential. On the other hand, there are risks that require thorough, nuanced consideration.

Supporters of the legislation argue that in an increasingly digital world, traditional approaches to fund management may no longer suffice. Bitcoin and other cryptocurrencies offer new pathways to enhance state revenue streams and provide a sort of financial insurance against economic turmoil. However, the concern remains that mixing highly volatile assets with essential public funds could lead to a precarious financial situation if not handled with care.

As the debate continues, it is essential for policymakers to take a balanced view. Here are some points that need serious consideration:

- Long-Term Impact: Any investment decision must weigh the long-term benefits against the possibility of short-term volatility, especially as public funds are involved.

- Transparency: Given the public accountability of state investments, there must be a high level of openness about how funds are managed and how decisions are made.

- Flexibility: The regulatory environment for cryptocurrencies is still evolving. State policies should be designed to adapt over time as new information and technologies come to light.

Fiscal responsibility in the digital age may well require embracing change while simultaneously devising bulletproof safeguards against the pitfalls that lie in the uncharted territory of digital assets.

Public Opinion and the Political Underpinnings of the Legislation

The conversation surrounding Texas’s move toward a Bitcoin reserve is not confined to the walls of state capitols. It has sparked broader public interest and debate over the role of digital assets in government fiscal policy. Some citizens see the move as bold and forward-thinking. Others remain skeptical, citing concerns over the unpredictable nature of cryptocurrencies and the possibility of mismanaging taxpayer money.

From a political perspective, it is important to note that such legislation is as much about signaling leadership as it is about practical outcomes. By stepping into new financial territory, Texas may also be sending a message to other states about its readiness to embrace emerging technologies. This sort of legislative experiment could set the stage for a broader policy shift that might redefine how state finances are managed in the future.

Key points in the political debate include:

- Leadership in Innovation: Texas is positioning itself as a pioneer, willing to work through the confusing bits of fiscal innovation to potentially reap economic benefits.

- Voter Confidence: Lawmakers must balance their innovative impulses with the need to maintain public trust. The management of state funds, especially in a volatile market, becomes a litmus test for responsible governance.

- Interstate Competition: With states like Arizona already moving in a similar direction, Texas may view this as a competitive bid to establish itself as a crypto-friendly state, which could have long-lasting economic implications.

Ultimately, the success of such initiatives will depend largely on how well the state can manage these little twists in policy and public opinion. The challenge lies in finding the right mix between audacity and caution—a balance that is critical for long-term fiscal stability.

Looking Ahead: The Future of State-Backed Cryptocurrency Reserves

Despite the pressures and uncertainties, the discussion around establishing a state-backed Bitcoin reserve continues to gain momentum. If Texas proceeds with SB21 and boasts a protected Bitcoin reserve under HB4488, it might very well pave the way for similar policies throughout the nation. The evolution of these policies will likely be incremental, involving a series of adjustments as both state and federal frameworks adapt to the digital economy.

Looking ahead, several questions will need to be answered:

- How will state financial managers cope with the additional challenges posed by digital assets?

- What level of oversight is necessary to ensure that state funds are not placed in overly volatile investments?

- Can a successful model be developed that other states can emulate, or will the experience in Texas remain an isolated experiment?

The answers to these questions will not come overnight. Instead, they are likely to be the result of ongoing trial and error as state policymakers learn to work through the tangled issues of integrating digital assets into traditional public finance.

Comparing Texas Legislation with National Trends in Crypto Policy

When analyzing Texas’s legislative developments, it is helpful to compare them with broader national initiatives. Some key national trends include:

| Trend | Description |

|---|---|

| Federal Proposals | Legislators at the federal level, such as those proposing a national Strategic Bitcoin Reserve, are exploring similar ideas on a broader scale. |

| State-Level Experiments | States like Arizona have already piloted crypto reserve funds, setting a potential template for Texas and others. |

| Regulatory Adaptation | Both state and federal bodies are facing the overwhelming challenge of adapting old regulations to account for the digital revolution in finance. |

| Public-Private Partnerships | Some initiatives suggest collaborative efforts between the government and the private sector to manage crypto investments, ensuring professional oversight and risk management. |

This broader context underlines that Texas’s legislative maneuvers are part of a larger, nationwide effort to find the best ways to incorporate digital assets into public financial management. As state governments continue to experiment with these policies, they must remain open to lessons learned from similar initiatives elsewhere.

Balancing Innovation with Prudence: Critical Takeaways

The developments in Texas force us to ask: How can a state remain at the cutting edge of financial innovation while also ensuring that public funds are managed in a secure and responsible manner? The dual objectives of fostering economic innovation and safeguarding taxpayer interests might seem like they are at odds, yet successful governance depends on blending the two effectively.

Legislators are faced with the task of managing your way through the ever-changing landscape of digital assets. Here are some considerations that encapsulate the challenge:

- Embracing Change: The willingness to explore new investment avenues is a hallmark of progressive policy. States must be prepared to take calculated risks in order to stay relevant in the digital economy.

- Ensuring Accountability: Given that any misstep could affect millions of taxpayers, transparency and accountability in fund management are not negotiable.

- Adapting Regulations: Existing legal frameworks must be flexible enough to accommodate the unique characteristics of digital assets without compromising their original protective intent.

Ultimately, the decision on SB21 will serve as a litmus test. It will reveal whether Texas can balance progressive financial innovation with the careful, critical oversight of public funds. The outcome of this experiment will provide valuable insights not only to Texas but also to other states contemplating similar measures.

Concluding Thoughts: Is Texas Ready for a Crypto Future?

The new wave of legislation surrounding state-backed cryptocurrency reserves is a bold step into uncharted territory. With HB4488 establishing a protective legal framework and SB21 poised to potentially authorize Bitcoin investments, Texas is at the brink of what could be a historic transformation of state financial policy. The move reflects a broader trend among U.S. states to get into the thick of digital asset management—a trend that might well redefine how state governments view and handle their funds.

Of course, such costly experiments come with their share of challenges. The fine points of navigating through a volatile market, coupled with the nerve-racking potential for unexpected downturns, mean that any decision to enlist in this new paradigm must be made with caution. Texas’s efforts to ensure clear, targeted fund allocation through legal safeguards represent a promising way forward—even if it remains a work in progress.

For those following these developments, the Texas saga offers much to ponder. The state’s decision regarding SB21, made against the backdrop of these legal and fiscal innovations, will likely send shockwaves through how we think about public fund management in the digital era. Whether you are a policy wonk, a crypto enthusiast, or simply an interested citizen, staying informed about these intricate policy discussions is essential.

In conclusion, while the future of a state-backed Bitcoin reserve is still uncertain, the steps taken by Texas indicate that change is on the horizon. As other states continue to watch and learn from these proceedings, one thing is clear: the digital revolution in public finance is no longer just a futuristic concept—it is happening now. Lawmakers, investors, and citizens alike must be ready to work through the tangled, confusing bits of this new economic landscape, finding the balance between innovation and prudence that will shape our financial future.

Ultimately, success in this domain will depend on a delicate, well-managed approach to risk and reward. Texas’s legislative move—if it translates into robust, actionable policy—could well be a beacon for future state initiatives aiming to integrate digital assets into conventional fiscal strategies. Only time will tell if the gamble on Bitcoin, like any investment, will pay off, but the conversation is undoubtedly productive and full of insights for anyone looking to take a closer look at the future of public finance in the digital age.

As citizens and policy observers, we are granted a front-row seat to this momentous experiment. The state’s ability to finely tune its approach over time—by learning from early challenges and adapting to the unexpected twists and turns—will define its legacy in the realm of innovative financial management. Texas, with its rich history of independent spirit and pragmatic governance, may just lead the charge—if it manages to steer through these nerve-racking challenges.

In summary, the debate surrounding Texas's potential Bitcoin reserve encapsulates many of the core challenges facing modern public policy: protecting public funds, embracing technological change, and crafting regulations that are both forward-thinking and secure. As we watch the developments unfold, it becomes clear that even in a field riddled with tension and loaded with issues, there is room for creative, resilient solutions. The coming months will undoubtedly reveal more about how well Texas can balance all these factors, and whether this experiment in state-level crypto investment will serve as a model for others. With thoughtful leadership and continued public debate, the path ahead, though filled with tricky parts and off-putting risks, might just lead to a brighter, more innovative future for state financial policy.

Originally Post From https://coinedition.com/texas-bitcoin-reserve-bill-hb4488-sb21/

Read more about this topic at

Texas Governor Greg Abbott has approved House Bill 448

89(R) HB 1598 - Introduced version - Bill Text

No comments:

Post a Comment